The $8 Million Lesson Every Cannabis Operator Must Learn

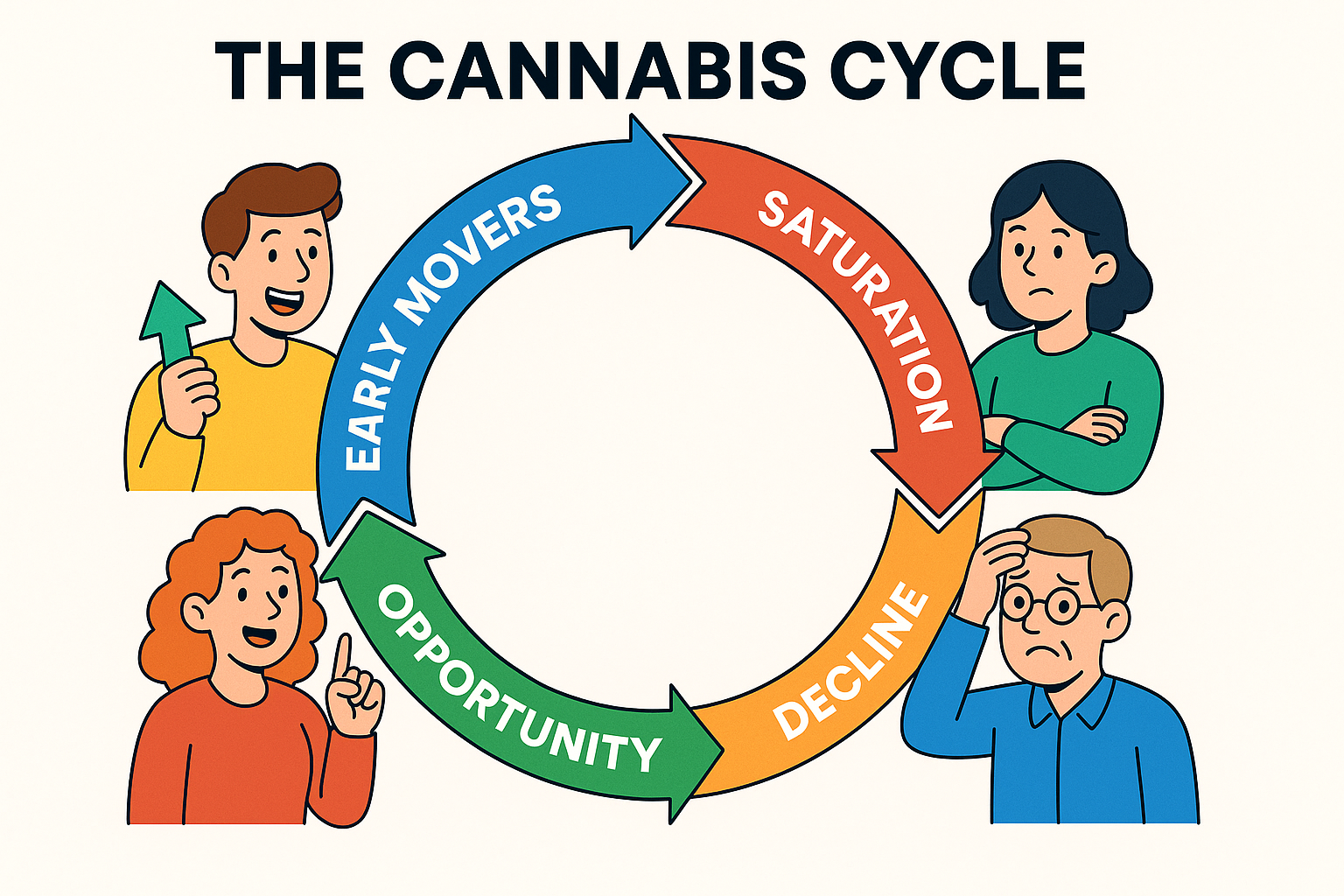

That’s not market volatility. That’s not bad luck. That’s a predictable market cycle that destroys 90% of cannabis wealth, but creates massive opportunities for the operators who understand it.

Here’s what happened: California opened adult-use in 2018. Early licenses hit $8 million. Smart operators sold. Others held, thinking prices would keep climbing. Six years later, licenses are being offered for free just to escape lease obligations.

Michigan tells the same story: Cultivation licenses exploded from 273 to 2,904 in four years. Flower prices collapsed 87%, from $516/oz to $69/oz. Early movers made fortunes. Late entrants got crushed.

Oklahoma was even worse: 36 dispensaries per 100,000 residents created a 64:1 supply-to-demand ratio. Licenses became liabilities overnight.

The brutal pattern: Every cannabis market follows the same four-phase cycle. License values peak in year 1, then decline 85-95% as markets saturate. The operators who win understand this. The ones who lose ignore it.

____________________________________________________________________________________________________

Current Opportunities: Market Intelligence Meets Deal Flow

We don’t just track these cycles, we position our operators to profit from them.

Here’s what’s available right now:

🔥 Growth Plays (Enter Before Saturation)

Kentucky Regional Licenses: Multiple licenses in multiple regions available – $2.1M-$4M range

Ohio Doors Open:

- Ohio Retail: $7M revenue, high-traffic location – $15M

- Ohio Portfolio: 3 retail + grow, must-sell package – $18M

Connecticut Vertical License: One of first approvals in CT, 2 retail + 15k+ sq ft cultivation minimum – $1.75M (after $3M state fee paid)

New Jersey Ready-to-Open Locations:

- Absecon: $1.5M – Doors just opened

- Delran: $600K – Shovel ready location

Washington DC Medical License: Medical retail license, needs location by September – $50K

🎯 Strategic Entry Points (Limited Windows)

New York Market Positions:

- Washington Heights: $4M+ revenue target year 1 – $3.5M

- Peekskill: $3.2M+ revenue target, expansion ready – $3.25M

- Standalone Licenses: Non-CAURD retail ($600K) and distribution ($800K)

Vermont Border Advantage:

- Brattleboro: 4,047 sq ft, MA/NH border location – $695K

💰 Value Plays (Proven Operations, Mature Market Prices)

California Established Operations:

- Moreno Valley: $2.4M revenue, $215K net income – $1.8M

- Santa Ana: $3.3M revenue, $250K net income – $2.475M

- Lake Elsinore: $3M revenue, $375K+ net income – $2.25M

Illinois Profitable Operations:

- Peoria Heights: $2M+ revenue, proven traffic location – $2.1M

- Matteson: $7.4M gross sales, includes real estate – $8-8.5M

Michigan Scale Play:

- Michigan Traverse City: $550K revenue, moveable license – $400K

To gain access to these more info on our locations please click here and enter your info.

____________________________________________________________________________________________________

The Perfect Storm: Why 2025 Is Your Best Window

Three forces are converging to create the best expansion opportunity in cannabis history:

1. Emerging markets offer growth potential while mature markets provide value opportunities

2. The $1.83 billion debt wall hitting major MSOs by 2026 will force distressed sales from quality operators

3. Federal rescheduling to Schedule III could reduce tax burden from 50% to 21%, creating a secondary opportunity cycle

Translation: Smart operators with available capital can acquire prime assets from distressed sellers while capturing growth in emerging markets.

But only if you move now.

____________________________________________________________________________________________________

The License Density Reality Check

The sweet spot: 3-5 licenses per 100,000 residents maintains sustainable economics.

The danger zone: States with 15+ licenses per 100,000 residents face inevitable value destruction.

- Washington (Decent): 556 retail licenses statewide = $8+ million average annual sales per dispensary

- Arizona (Controlled): Limited licensing = $8.3 million average dispensary revenue

- Oregon (Oversaturated): 16.8 dispensaries per 100,000 residents = wholesale prices collapsed from $3,000/lb to $100/lb

- Oklahoma (Catastrophic): 36 dispensaries per 100,000 residents = 64:1 supply-to-demand ratio

Key Insight: Markets that control license supply maintain operator profitability. Markets that don’t, destroy wealth.

____________________________________________________________________________________________________

The CannDev Difference: Timing + Intelligence + Deal Flow

We’ve tracked every major cannabis market launch since 2016. We know which markets offer sustainable economics and which are value traps. We know when to enter for growth and when to buy for value.

Most importantly: We know the operators who built wealth understood market cycles. The ones who lost everything ignored them.

Our operators understand:

✓ When to enter emerging markets for maximum growth capture

✓ How to identify value opportunities in mature markets

✓ Why timing determines expansion success more than location

✓ Which markets offer sustainable economics vs. value traps

Ready to build your multi-state expansion strategy before the window closes?

Our market intelligence combined with exclusive deal flow creates opportunities others miss. But only for operators who act while the cycles are still in their favor.

____________________________________________________________________________________________________

The cannabis market doesn’t wait. Neither should your expansion strategy.

To gain access to these more info on our locations please click here and enter your info.

____________________________________________________________________________________________________

Who is CannDev?

CannDev is a cannabis retail developer with 150+ projects launched nationwide.

We help operators expand by securing prime locations, handling zoning/regulatory work, and offering lease-back deals so you scale without tying up capital.

We provide market intel: traffic counts, demographics, and competitive analysis for data-driven decisions.

MSO or up and coming operator, we get you open, licensed, and operational faster.

Click Here to Learn More